Most managed investments including Exchange Traded Funds (ETFs) are offered by way of units in a unit trust. Units are to a unit trust what shares are to a company; they are the bits that fractionalise ownership. Unit prices often fall on the 1st of July when distributions are paid. Why does this happen? The […]

Term Deposits: The Upside of Higher Interest Rates

Rising interest rates bring many disadvantages to individuals in the economy – especially for anyone with debt – so it’s unsurprising that most of us approach the news of another rate hike with trepidation. But one key advantage of higher rates is the better returns on savings accounts and term deposits. Over the last 12 […]

2022 in Review

As the end of the year approaches yet again, you might be reflecting on how things have changed over the past 12 months. Many unexpected world events have happened lately, including a global pandemic, war in Ukraine, and inflation taking over. Well composed articles about the future can be entertaining, but little more. However educated […]

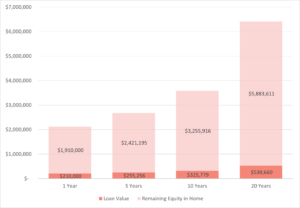

Reverse Mortgages

It’s a common scenario for older Australians – asset rich, cash poor. Owning a valuable home and having little income can be an issue, but there are ways around this other than selling your house. Below we look at the workings of a reverse mortgage. What are they? It is called a reverse mortgage as […]

What is a Super Co-Contribution?

Super co-contributions are an initiative by the government to encourage low or middle-income earners to put money into their retirement savings. Basically it works like this: if you earn below a certain amount and you make a personal contribution to your super fund, the government will also make a co-contribution to your super fund. Yes, […]