You may have read about Armaguard Australia in the news recently. Armaguard is one of the nation’s last remaining cash transit companies, servicing stakeholders across the banking, retail, hospitality, medical and government sectors. The company has been teetering on the brink of collapse. Its recent risk of insolvency has been due primarily to one thing: […]

What are ETFs and how do they work?

Exchange-traded funds (ETFs) give investors a cost-effective avenue for capturing the returns of an asset class, an index, or a commodity. While the name is fairly new, ETFs are simply managed funds which can be bought and sold through a stockbroker, mirroring the process of trading shares. How ETFs Operate An ETF is just a […]

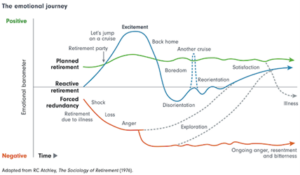

Retirement Planning: it’s not all about the money

According to recent analysis from KPMG, the average retirement age for Australians is the highest it’s been since the 1970s. More people over the age of 55 are staying in the workforce than ever before, whether through choice or necessity. Retirement is a significant life event for the vast majority of Australians. Most of us […]

Extra, Extra, Don’t Read All About It

This article was originally featured on the Align Financial blog on 18 December 2018. If you’re reading the investment headlines in the news around this time of year, then you might start to feel a bit of anxiety around whether your investments are well placed. Reading the news is one thing but acting on it […]

ESG Investing – what is it and how does it work?

In recent years, ESG investing (also called sustainable, ethical or responsible investing) has taken a more prominent role in management and investment decisions. But what exactly does ESG mean, and how does it affect your investment portfolio? ESG stands for Environmental, Social, and Governance and is a way of measuring and assessing a firm’s sustainability […]