In recent years, ESG investing (also called sustainable, ethical or responsible investing) has taken a more prominent role in management and investment decisions. But what exactly does ESG mean, and how does it affect your investment portfolio? ESG stands for Environmental, Social, and Governance and is a way of measuring and assessing a firm’s sustainability […]

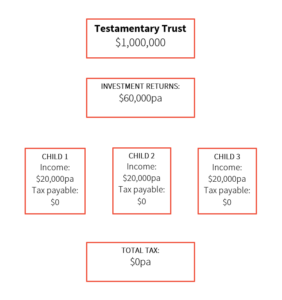

An introduction to Testamentary Trusts

If you have a Will in place, you could be mistaken for thinking that your estate planning is taken care of. But have you considered if your Will can stand up to obstacles that your children may face such as divorce, bankruptcy, long-term illness? One way lawyers protect against such events is by incorporating Testamentary […]

Currency Hedging

If your portfolio contains assets held in a foreign currency, there is a risk that returns might be impacted by fluctuations in exchange rates. As a result, it can be worthwhile knowing how currency fluctuations impact returns. But what exactly is currency hedging, and is it worth the extra costs? How do currency fluctuations affect […]

Super Recontribution Strategy

Although it may sound a little odd, taking money out of super and putting it back in can actually be beneficial by reducing the amount of potential tax you or your dependents may pay in the future. A recontribution strategy aims to increase the ‘tax-free’ component of your super account while reducing the ‘taxable’ amount. […]

Interest rates are higher, why aren’t house prices lower?

Rising interest rates usually mean bad news for homeowners, as the cost of servicing existing mortgages goes up and consumers start to feel the pinch. You’d expect this to have a knock-on effect on house prices – higher rates should mean lower house prices as more people are pushed out of (or unable to enter) […]