If you have a Will in place, you could be mistaken for thinking that your estate planning is taken care of. But have you considered if your Will can stand up to obstacles that your children may face such as divorce, bankruptcy, long-term illness? One way lawyers protect against such events is by incorporating Testamentary trusts into a Will.

A testamentary trust is simply a trust established in a Will. Most testamentary trusts are similar to family discretionary trusts which are established during the lifetime of a person. They both have potential beneficiaries, a trustee, property, and rules known as a ‘trust deed’.

Testamentary trusts are similar to family discretionary trusts, but they only come into effect once you pass away. The trustee/s (person/s in charge of the trust) then has discretion to disperse the assets to the beneficiaries (those receiving the assets). This usually allows the trustee (who could also be the beneficiary) to distribute the income/capital in a manner they see fit.

The trustee follows the rules of the trust deed and often has the authority to distribute in a way which can help manage taxes, protect against divorce, lessen the chance of bankruptcy claims and/or divert money away from a beneficiary who may be irresponsible with their spending.

Testamentary trusts have benefits, but they come at a cost. Here’s a quick summary of pros and cons:

Advantages

Income Splitting

Distributions can be made to the most appropriate beneficiaries in the trust, as overseen by the trustees. This allows income to be distributed where it is needed and benefits most – to a beneficiary in a lower tax bracket (e.g., minors), or capital gains can be transferred to someone who has losses available.

Beneficiaries Under 18

Beneficiaries under 18 years old are treated as adults for taxation purposes in testamentary trusts, which can help a family better manage their income tax. This can mean significant tax savings for beneficiaries who can “split income” with their children.

Increased Protection of Assets Against Bankruptcy or Financial Trouble

If one of the trust beneficiaries is bankrupt or in serious financial trouble, instead of using the trust assets to satisfy any outstanding debts, the assets are harder (but not impossible) for creditors to attack as they are not owned by the beneficiary and are instead legally owned by the trustee.

Protection Against Irresponsible Spenders

Beneficiaries who spend unnecessarily and/or irresponsibly can be temporarily excluded as income recipients as determined by the trustee. If the habits of such beneficiaries change over time the trustee can elect to distribute income to them at a later time.

Protection Against a Relationship Breakdown

A breakdown in a marriage or long-term relationship would often lead to assets being considered when dividing the couple’s property. With a testamentary trust, the beneficiaries don’t actually own the assets so they are not usually considered when dividing up matrimonial assets.

Distribution Flexibility

Income can be distributed amongst members of the family to create tax advantages. This ties in with utilising lack of taxable income from minors to create further tax advantages. Testamentary trusts can be valid for up to 80 years, so flexibility in distribution can also be carried over generations.

Disadvantages

Cost and Complexity

Testamentary trusts cost money to maintain and there must be at least one trustee to govern the trust. The trustee will likely require legal, financial and accounting advice which all cost money. The trust must prepare annual accounts and lodge a tax return each year.

Suitable Person

A Testamentary trust can’t exist without a trustee. The trustee is responsible for the management and operation of the trust.

Example of the Benefits

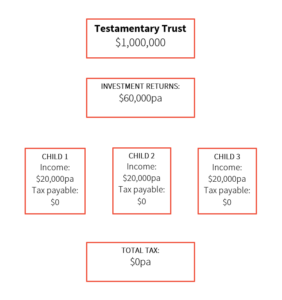

Simon is married to Fiona, and they have 3 young children. In Simon’s Simple Will, he leaves his assets directly to Fiona. Simon dies and Fiona receives $1,000,000. She invests this amount and earns 6% taxable income.

In a Simple Will, the $60,000 p.a. income from this investment is taxable income for Fiona. The tax would come out to around $15,000, leaving her with only $45,000 per annum to raise the family.

With the same situation in a Testamentary Trust, her 3 children are named as beneficiaries. This means the trust income can be split between her 3 kids. As testamentary trusts treat all minors as adults for tax purposes. This income is taxed at a significantly reduced rate, meaning the total tax could drop to ZERO. This is a $15,000 decrease from the Simple Will.