The recent 50% reduction in the minimum Account Based Pension withdrawal requirement came to an end on 1 July 2023. This was a temporary measure during and after COVID and was designed to reduce the depletion of ABPs in times of lower investment returns. From 1 July 2023, the minimum withdrawal percentages are reverting to […]

Blog

What is an SMSF and is it right for you?

What is an SMSF? A Self-Managed Super Fund (SMSF) does what it says on the tin – you manage your superannuation yourself, instead of delegating the management of your retirement savings to a large institution. In practice, very few people “Self Manage” their retirement savings entirely as they enlist the help of an adviser to […]

Why Do Unit Prices Fall After 30 June?

Most managed investments including Exchange Traded Funds (ETFs) are offered by way of units in a unit trust. Units are to a unit trust what shares are to a company; they are the bits that fractionalise ownership. Unit prices often fall on the 1st of July when distributions are paid. Why does this happen? The […]

Term Deposits: The Upside of Higher Interest Rates

Rising interest rates bring many disadvantages to individuals in the economy – especially for anyone with debt – so it’s unsurprising that most of us approach the news of another rate hike with trepidation. But one key advantage of higher rates is the better returns on savings accounts and term deposits. Over the last 12 […]

End of Financial Year Tax Return Tips

Our super-organised readers probably associate 30 June with preparing your tax return, so here are a few tips to help you out. While the exact nature of whether an expense is tax deductible is on a case by base basis, the following is a guide as to what you may be able to. For most […]

2022 in Review

As the end of the year approaches yet again, you might be reflecting on how things have changed over the past 12 months. Many unexpected world events have happened lately, including a global pandemic, war in Ukraine, and inflation taking over. Well composed articles about the future can be entertaining, but little more. However educated […]

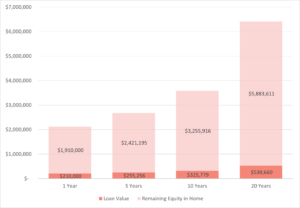

Reverse Mortgages

It’s a common scenario for older Australians – asset rich, cash poor. Owning a valuable home and having little income can be an issue, but there are ways around this other than selling your house. Below we look at the workings of a reverse mortgage. What are they? It is called a reverse mortgage as […]

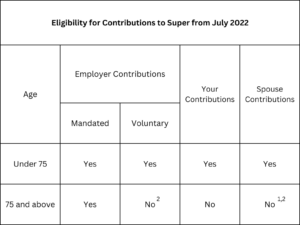

New Super Contribution Rules

Good news for older Australians wanting to save for your retirement. For those age 67-74, you no longer need to meet ‘the work test’ when making a personal super contributions. Prior to 1 July 2022, anyone aged 67-74 had to work ’40 hours in a 30 day period’ in order to put money into super. […]

7 Must Haves of an Effective Estate Plan

Planning an estate isn’t always easy and for this reason many people don’t get around to doing it properly. Careful estate planning involves the process of structuring your personal and financial ‘stuff’ so that the right people get the right amount of ‘stuff’ at the right time. This includes ensuring prized personal possessions and financial […]

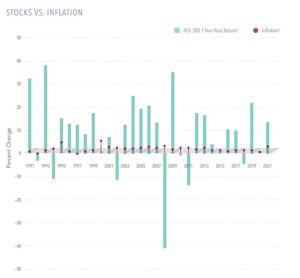

What Does Rising Inflation Mean for Share Markets?

A question that I am being asked more and more is whether we should make changes to an investment portfolio as a result of rising inflation. The answer is mostly good news – Inflation isn’t necessarily bad news for stocks. (It isn’t necessarily good, either). A look at the Australian share market performance over the […]