Many Australians approaching retirement start questioning whether their superannuation balance is enough. According to the Association of Superannuation Funds of Australia (AFSA), most Australians don’t have enough saved and are at risk of facing a lower standard of living once they stop working[1]. There are no scholarships, grants or loans for retirement so a little planning ahead while you’re still earning an income can mean a world of difference when it comes to the non-working part of your life.

So how much exactly do you need to retire? There are several factors to consider when trying to pinpoint a figure. The first step is to think about these three key areas:

Lifestyle

What are your current living expenses? What kind of lifestyle changes do you want/need/dream of when you retire? For some households, $40,000 is enough for them to live comfortably. For others, the number is closer to $240,000. There is no right or wrong answer and living expenses can and do vary significantly from one household to the next. And one of the important unexpected retirement expenses to plan for is inflation, or the rising cost of goods and services.

Income

How much money will you have in retirement? Your income can come from a number of sources including:

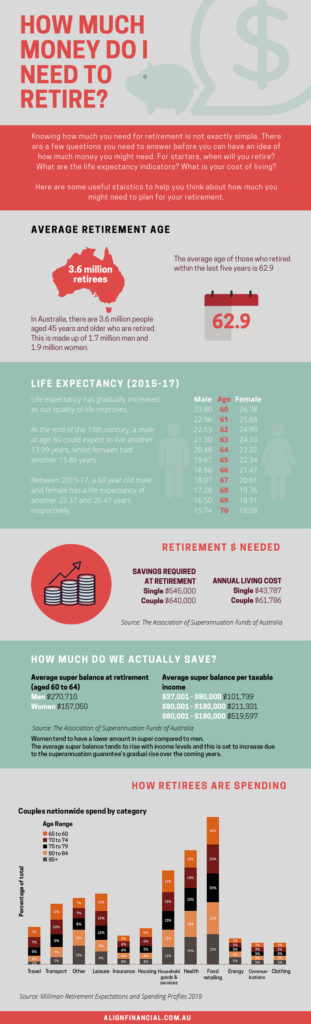

– Superannuation: this is likely to form the majority of your retirement income and will be an important part of your planning. Women, in particular, need to think about their super pot. The 2016 Census in Australia showed a huge disparity in retirement income between men and women.

– Investments and savings: investing your money is a great way to generate passive income and grow your nest egg when you no longer work.

– Age pension: if you are eligible, you may be able to receive government assistance in the form of a full or part age pension from Centrelink. An income and assets test will apply to see if you qualify.

– Inheritance: while not guaranteed, many Australians will inherit something at some time in their lives which can help provide retirement income (depending on when it is received).

It is also becoming more common for people in the 21st century to progressively ease into retirement rather than stopping work altogether on your 65th birthday (as my Grandpa did in 1985). We see people going from a 5 day week to a 2 or 3 day week, working part-time or continuing on a casual basis. Having a source of income and still being engaged in work can be a wonderful thing for many people, and there’s the option of still having a pension from your superannuation while you work part-time (called a Transition-to-Retirement pension).

Life expectancy

In 1891, males and females were expected to live till the ages of 51 and 54 respectively. We’re hanging around longer nowadays thanks to better healthcare and better quality of life. Whilst this is great, it also means we need to save more money than ever before.

We’ve compiled a helpful infographic with all the essential stats that you need to know; including retirement age, life expectancy, the amount of money AFSA surveys suggest is needed for a comfortable retired life, the amount Australians are actually saving and how we actually spend during retirement. We hope these insights will help you plan holistically for your retirement.

And finally, it is one thing to know what you are retiring from, it is far more important to know what you are retiring to. Having continued purpose/relevance/interaction is crucial to a long and happy retirement.

[1] Better Retirement Outcomes: a snapshot of account balances in Australia, July 2019, The Association of Superannuation Funds of Australia.

What Can Align Financial Do For You? Visit our homepage to learn more about our service. If you would like to speak to us about your financial circumstance, please feel free to give us a call on 02 9913 9995. We are located in Narrabeen on the Northern Beaches of Sydney.

.

Disclaimer: This post has been prepared for general information purposes only. It is not specific advice to any particular person. You should consult an authorised Align Financial adviser before making financial decisions. Align Financial | Financial Planner Northern Beaches | Servicing North Narrabeen, Narrabeen, Mona Vale, Elanora Heights, Newport, Avalon, Palm Beach | Enquire with us online

.