Rising interest rates bring many disadvantages to individuals in the economy – especially for anyone with debt – so it’s unsurprising that most of us approach the news of another rate hike with trepidation. But one key advantage of higher rates is the better returns on savings accounts and term deposits. Over the last 12 […]

End of Financial Year Tax Return Tips

Our super-organised readers probably associate 30 June with preparing your tax return, so here are a few tips to help you out. While the exact nature of whether an expense is tax deductible is on a case by base basis, the following is a guide as to what you may be able to. For most […]

2022 in Review

As the end of the year approaches yet again, you might be reflecting on how things have changed over the past 12 months. Many unexpected world events have happened lately, including a global pandemic, war in Ukraine, and inflation taking over. Well composed articles about the future can be entertaining, but little more. However educated […]

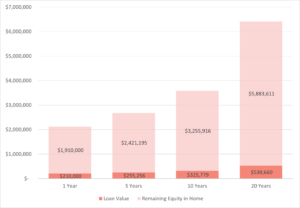

Reverse Mortgages

It’s a common scenario for older Australians – asset rich, cash poor. Owning a valuable home and having little income can be an issue, but there are ways around this other than selling your house. Below we look at the workings of a reverse mortgage. What are they? It is called a reverse mortgage as […]

2020-21 Federal Budget: 3 Key Take-Aways

The impact of COVID-19 on the economy has delayed the release of the Federal Budget this year to October instead of the usual May announcement. On Tuesday (6th Oct 2020), Treasurer Josh Frydenberg proposed a range of measures to get our economy back on it’s feet, albeit a third wave of COVID-19. Financial Life Planner […]