A Will is an important legal document that states how you want your property and assets to be distributed when you die, to whom (your beneficiaries) and who should manage the process (your Will’s executor). If someone dies without a valid Will, they’re said to have died “intestate”. In such cases, intestacy laws apply, and […]

Five tips for digital estate planning

Most people make plans to dispose of their tangible property after they’re gone, but these days, we all have an awful lot of intangible property to deal with as well. You may not be too concerned about what’s going to happen to your email or social media account after you die, but there are some […]

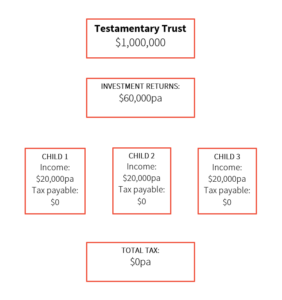

An introduction to Testamentary Trusts

If you have a Will in place, you could be mistaken for thinking that your estate planning is taken care of. But have you considered if your Will can stand up to obstacles that your children may face such as divorce, bankruptcy, long-term illness? One way lawyers protect against such events is by incorporating Testamentary […]

Super Recontribution Strategy

Although it may sound a little odd, taking money out of super and putting it back in can actually be beneficial by reducing the amount of potential tax you or your dependents may pay in the future. A recontribution strategy aims to increase the ‘tax-free’ component of your super account while reducing the ‘taxable’ amount. […]

7 Must Haves of an Effective Estate Plan

Planning an estate isn’t always easy and for this reason many people don’t get around to doing it properly. Careful estate planning involves the process of structuring your personal and financial ‘stuff’ so that the right people get the right amount of ‘stuff’ at the right time. This includes ensuring prized personal possessions and financial […]