Recession, recession, recession.

These words are being shouted across media headlines and newspapers around the world as we deal with the impacts of COVID-19.

It is indeed a difficult time for investors as we face economic challenges stemmed from a pandemic that no one could have predicted. But the headlines that we in Australia are facing a recession for the first time in nearly 30 years is both worrying and confusing.

What about the Global Financial Crisis? Wasn’t that a recession? Should we be particularly fazed about this recession happening now?

Firstly, let us unpack how a recession is defined.

What is a Recession?

There are varying definitions of what a recession is around the world but, broadly speaking, it is when the economy fails to grow and falls into a trough (a negative) for a sustained period.

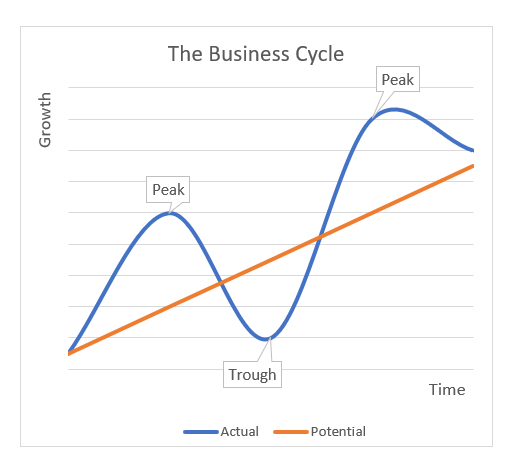

Much like a business cycle where growth can fluctuate, the economy works in the same way, having periods of highs and periods of lows.

When we experience a trough; a period of lows, it usually results in job losses and an increase in unemployment.

It can put a lot of financial stress on businesses and households and the economy essentially slows down or halts.

One of the most common definition of a recession referred to in the media or in textbooks, is a ‘technical recession’ – where there are two consecutive quarters of negative growth.

Are we in a Recession?

The Treasurer declared Australia to be in a recession in early June.

The second quarter of April to June had not passed but it was well projected that the Australian economy would shrink again in the second quarter after an 0.3% drop for the first quarter.

The Commonwealth Bank of Australia forecasts that the Australian economy will contract by 6.2% in the second quarter of 2020.

The last recession in Australia occurred in 1991.

However there have been significant downturns that have impacted the Australian economy since then, including the Global Financial Crisis of 2008-2009.

It is useful to keep this in mind when reading media headlines that seem alarming.

There have been other economic downturns that we have recovered from in the past 30 years and the economy will recover again.

History shows us that out of the past 15 recessions in the US, 11 of those saw share markets post a positive return within two years of the start of the recession began.

It can be tempting to sell shares when there is a heightened risk of an economic downturn, but research shows that share prices are forward looking and will generally have fallen in value before a recession even begins.

For long-term investors, there is really no reason why the word ‘recession’ should faze you. A recession is a natural phase of the market cycle and there are benefits.

The Positives to a Recession

Much like a business cycle, the economy also has a natural progression of highs and lows.

The lows still form a part of a healthy cycle in the overall picture despite the difficulties they bring.

Some of the beneficial effects of a recession are:

Balancing growth

The economy is growing on a larger scale but progressively up and down.

If growth is continually an upwards trajectory and never slowed down it would mean higher wages which could lead to higher inflation, meaning a higher cost for everyday goods.

A recession helps slow down the economy and can reset prices to a more manageable level.

People are thinking about their savings

During difficult times, people tend to think more about their savings and whether they have enough for the future.

Credit and borrowing are generally down as people prepare and plan to ensure they will get through tougher times.

Whilst this is not great for the economy, it is good practice for many Australians who may not usually think about saving and planning for their future. A recession can be a turning point to the way people think (or not think) about their finances.

Buying opportunities

Tougher economic conditions can mean opportunities to purchase shares at a lower price, which can be beneficial for those looking to enter the market.

The same principles of investing still applies after purchase where investors need to wait for a recovery in the market before they see a gain.

In an ideal world we would prefer not to have a recession. But when they occur, it is important to understand what they mean and what the benefits of this economic situation can mean for investors in the long run.

What Can Align Financial Do For You? Visit our homepage to learn more about our service. If you would like to speak to us about your financial circumstance, please feel free to give us a call on 02 9913 9995. We are located in Narrabeen on the Northern Beaches of Sydney.

.

Disclaimer: This post has been prepared for general information purposes only. It is not specific advice to any particular person. You should consult an authorised Align Financial adviser before making financial decisions. Align Financial | Financial Planner Northern Beaches | Servicing North Narrabeen, Narrabeen, Mona Vale, Elanora Heights, Newport, Avalon, Palm Beach | Enquire with us online

.