![]()

Exchange Traded Funds (ETFs) are essentially managed investments that are bought and sold on a stock exchange. ETFs are traded in the same way you buy shares on the Australian Securities Exchange (ASX). They can be a simple and low-cost way to get investment returns and provide a diversified investment in one simple transaction.

How Do They Work?

Like a managed investment, when you invest in an ETF it will buy a portfolio of investments on your behalf. For example, if you invest in an ETF that seeks to track the S&P/ASX 200, in a single trade you effectively own shares in all of the largest 200 companies on the ASX.

How Are They Priced?

The share price for an ETF is based on the Net Asset Value (NAV). The NAV is the sum of the underlying shares that the ETF owns. ETFs typically trade at prices that match the NAV, however they can trade above or below their NAV. It is prudent to check the most recent NAV before trading an ETF.

Who Creates ETFs?

ETFs are issued by a range of providers, most commonly investment managers who already offer an unlisted managed investment of the same nature.

ETF Benefits

- Bought and sold on the ASX

- Invest in global companies via an Australian based investment

- Diversification in one trade

- Transparent portfolio holdings

- Can be sold readily if needed (providing the underlying shares can be sold)

- Investments are priced daily

- Own hundreds of companies in a single investment

- Avoid the risks of the ‘4 stock portfolio’ (eg. Telstra, Qantas, AMP, IAG)

- Generally low cost

ETF Risks

- Liquidity of many ETFs has not been tested in a financial crisis / share-market crash

- The price of an ETF (market value) can be less than the sum of all of the shares that it owns (Net Asset Value).

ETF Example

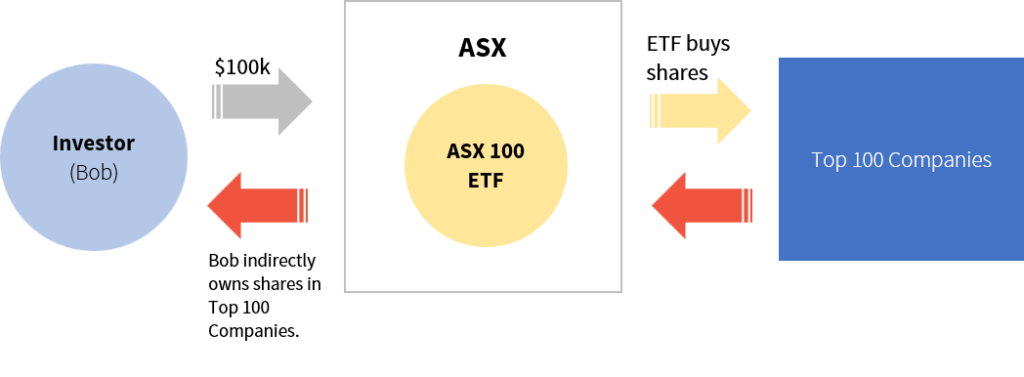

Bob wants to invest $100,000 into the ASX 100 ETF on the Australian Stock Exchange.

Bob now indirectly owns shares in the Top 100 companies, collects dividends and is subject to share price movements of the portfolio of shares as a whole.

What Can Align Financial Do For You? Visit our homepage to learn more about our service. If you would like to speak to us about your financial circumstance, please feel free to give us a call on 02 9913 9995. We are located in Narrabeen on the Northern Beaches of Sydney.

Disclaimer: This post has been prepared for general information purposes only. It is not specific advice to any particular person. You should consult an authorised Align Financial adviser before making financial decisions. Align Financial | Financial Planner Northern Beaches | Servicing North Narrabeen, Narrabeen, Mona Vale, Elanora Heights, Newport, Avalon, Palm Beach | Enquire with us online.