Financial wellbeing means different things in different countries. What does financial wellbeing mean for Australians? Around the world, national programs are being developed to help improve financial literacy in the public realm. In Australia, similar efforts are occurring through organisations such as ASIC and Financial Literacy Australia with the aim of creating a better-informed public to successfully navigate their financial life and encourage stakeholders that have a role to play in bettering financial outcomes for the public.

The start of this journey is a recent report commissioned by ASIC titled ‘Exploring Financial Wellbeing in the Australian Context’. The results of a survey among the Australian public found a collective definition of financial wellbeing as:

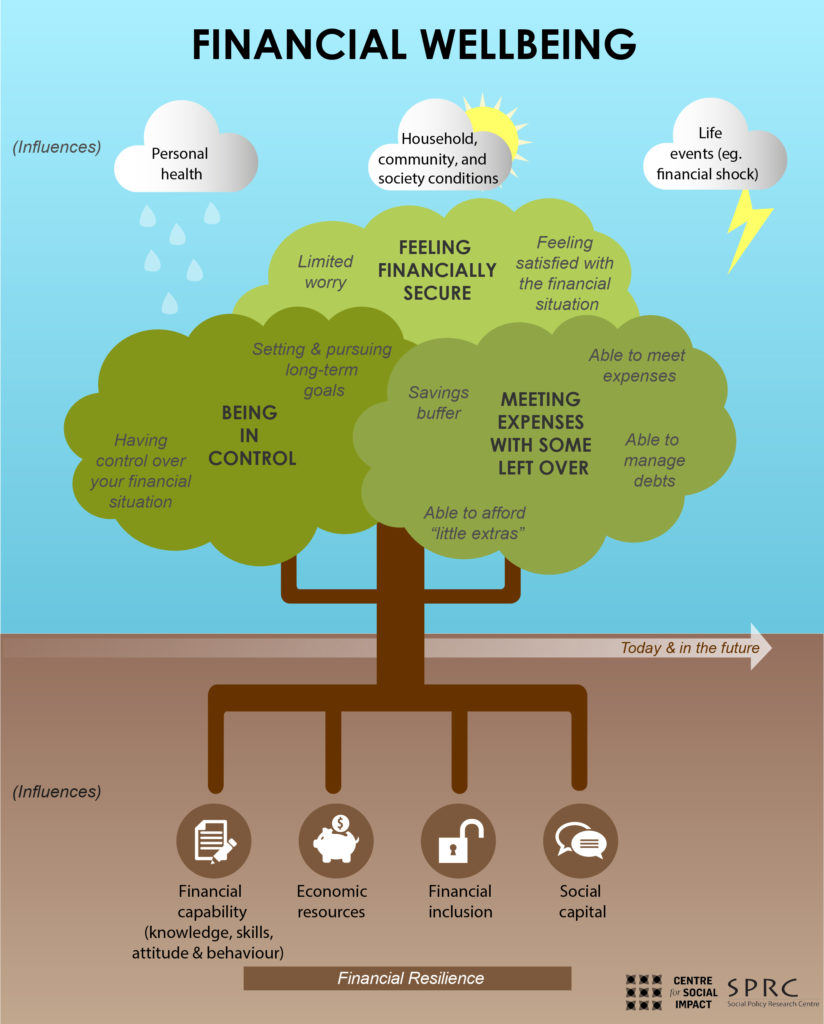

“Financial wellbeing is when a person is able to meet expenses and has some money left over, is in control of their finances and feels financially secure, now and in the future.”

If we think of our financial wellbeing as sitting in an ecological system with different influencing factors that affect its health, the root system that forms the foundations of our financial wellbeing ‘tree’ would consist of a few different elements.

Financial capability

Having a higher level of financial knowledge, a positive attitude towards money may influence better behaviours that lead to greater financial wellbeing. The relationship between these components are highly complex and it means these can be interpreted in different ways for different people depending on your individual influences.

Financial inclusion

Having access to appropriate and affordable financial services is important to financial wellbeing. These can include a bank account, insurance and line of credit. Although certain demographics viewed having a line of credit such as a credit card as ‘bad’ debt, they felt it served as a security net.

Social capital

People reported greater financial wellbeing when they had support from family, friends and community services. They might help to cover basic needs and expenses, or to meet an unexpected expense.

Economic resources

Income is fundamental to financial wellbeing. This not only includes the amount of income but also the stability and source of the income, e.g. is the work regular and secure? Is it from work or a government payment?

There’s also other influences to our financial wellbeing in the form of external circumstances. Being able to ‘weather’ changing life events that impact on an individual’s financial circumstance include things like:

Health

Health circumstances affect your financial wellbeing. The report found that health, particularly mental health, was a strong influence in one’s financial wellbeing.

Household, community and society conditions

Household conditions include being able to afford your standard of living, whilst the socio-economic status of the community or neighbourhood you live in also affects your financial wellbeing.

Life events

Marriage, divorce and the loss of loved ones are not only some of the most stressful life events mentally and emotionally, but financially challenging as well.

Financial wellbeing is the sum of many different parts, not just your income figure. Wellbeing is not just objective but also subjective, e.g. how a person feels about their money. The better approach to maintaining or improving your financial wellbeing is to look at a more holistic picture that considers all of the above elements.

If you’d like to view the full report, click here.

What Can Align Financial Do For You? Visit our homepage to learn more about our service. If you would like to speak to us about your financial circumstance, please feel free to give us a call on 02 9913 9995. We are located in Narrabeen on the Northern Beaches of Sydney.

Disclaimer: This post has been prepared for general information purposes only. It is not specific advice to any particular person. You should consult an authorised Align Financial adviser before making financial decisions. Align Financial | Financial Planner Northern Beaches | Servicing North Narrabeen, Narrabeen, Mona Vale, Elanora Heights, Newport, Avalon, Palm Beach | Enquire with us online.