Rising interest rates usually mean bad news for homeowners, as the cost of servicing existing mortgages goes up and consumers start to feel the pinch. You’d expect this to have a knock-on effect on house prices – higher rates should mean lower house prices as more people are pushed out of (or unable to enter) […]

Reverse Mortgages

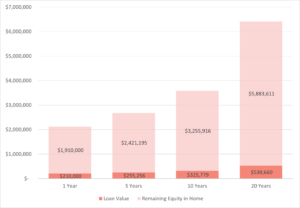

It’s a common scenario for older Australians – asset rich, cash poor. Owning a valuable home and having little income can be an issue, but there are ways around this other than selling your house. Below we look at the workings of a reverse mortgage. What are they? It is called a reverse mortgage as […]

Royal Commission Key Recommendations & Our Thoughts

Commissioner Kenneth Hayne has released the final report to last year’s 68 days of hearing where the banking, superannuation and financial services sector came under the spotlight for misconduct. Hayne’s final report included 76 recommendations, most of which the Morrison government and Labor say they will support and implement. Here are some of the key […]

Super vs Mortgage

Many people wait until their home loan is paid off before investing more in super. However, if you are currently making more than the minimum home loan repayments, you may be better off making additional super contributions instead of additional loan repayments. Why super? There are two key reasons why topping up your super could […]