In yet another cautionary tale to consumers, financial advisory firm United Global Capital (UGC) and its associated Global Capital Property Fund (GCPF) were shut down by the Federal Court in Victoria recently due to serious issues in their operations. UGC’s business model involved several practices that created a clear conflict of interest, with the firm […]

Interest rates are higher, why aren’t house prices lower?

Rising interest rates usually mean bad news for homeowners, as the cost of servicing existing mortgages goes up and consumers start to feel the pinch. You’d expect this to have a knock-on effect on house prices – higher rates should mean lower house prices as more people are pushed out of (or unable to enter) […]

Higher Minimum Pensions from 1 July 2023

The recent 50% reduction in the minimum Account Based Pension withdrawal requirement came to an end on 1 July 2023. This was a temporary measure during and after COVID and was designed to reduce the depletion of ABPs in times of lower investment returns. From 1 July 2023, the minimum withdrawal percentages are reverting to […]

2022 in Review

As the end of the year approaches yet again, you might be reflecting on how things have changed over the past 12 months. Many unexpected world events have happened lately, including a global pandemic, war in Ukraine, and inflation taking over. Well composed articles about the future can be entertaining, but little more. However educated […]

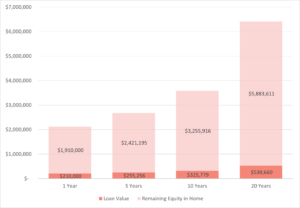

Reverse Mortgages

It’s a common scenario for older Australians – asset rich, cash poor. Owning a valuable home and having little income can be an issue, but there are ways around this other than selling your house. Below we look at the workings of a reverse mortgage. What are they? It is called a reverse mortgage as […]