Inflation – or the increase in the price of goods and services over time – has been in the news a lot lately.

In Australia, the Consumer Price Index (CPI) is the most well-known indicator of inflation. The CPI measures the percentage change over 12 months in the price of a basket of typical household goods and services.

To calculate CPI, the Australian Bureau of Statistics (ABS) gathers prices for thousands of individual consumer items across 87 different household spending categories and compares them with prices from the previous quarter*.

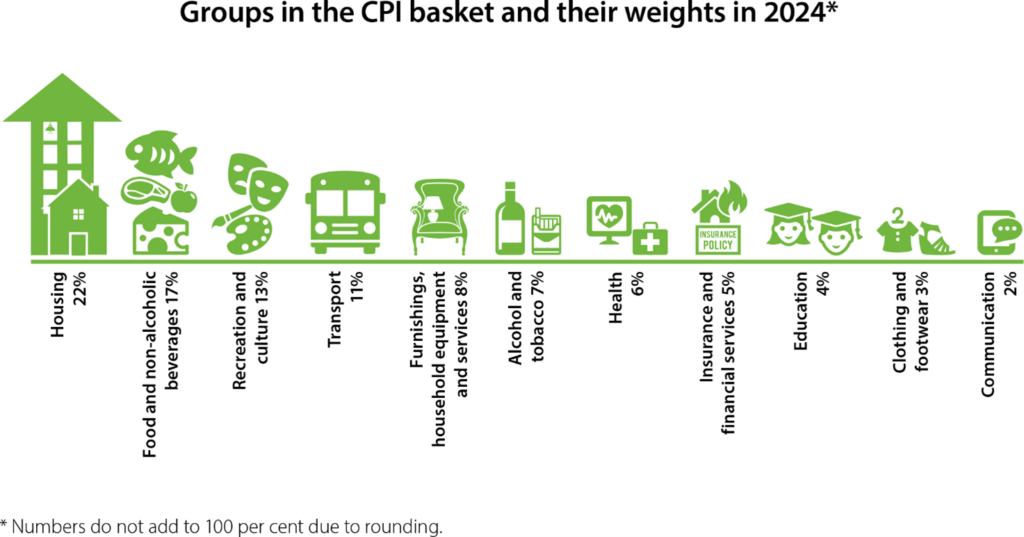

The 87 categories are put into 11 expenditure groups, and statisticians then calculate the inflation rate for each group.

The image below shows the 11 groups of goods and services included in the CPI calculation and their current inflation rate (at time of writing) – That is, it shows how much more we’ve been paying (as a percentage) for goods and services over the past 12 months.

Source: https://www.rba.gov.au/education/resources/explainers/inflation-and-its-measurement.html#fn1

Yep … Ouch.

You shouldn’t be surprised if the breakfast cereal you bought 12 months ago for $5.99 is now on the shelf for around $7.

And if the price of your $5.99 box of cereal has stayed the same, chances are that its packaging hasn’t. It’s more likely to have shrunk – selling you less product for the same price – a concept known as ‘shrinkflation’, which affects many products in supermarket aisles.

While you may be feeling the pinch from inflated prices, Australia’s inflation rate is still fairly tame considering the major disruptions caused by the COVID-19 pandemic.

Most economies strive to have a moderate rate of inflation, and certainly extreme inflation (or ‘hyperinflation’) can shake consumer confidence and a whole economy.

But that said, the opposite of inflation – deflation (when prices fall, and the supply of goods and services is higher than demand) also has its drawbacks. Just like extreme inflation, extreme deflation can also be detrimental to many.

Essentially, monetary policy seeks to find a balance. Central banks around the world walk a delicate economic tightrope with interest rates as their balancing pole.

At the end of the June quarter 2024, Australia’s inflation rate was sitting at 3.8% – Still outside the RBA’s target inflation range of 2-3%, but it seems the increased interest rates have served to curb spending and ease inflationary pressures.

It’s good to remember at this point that there are still ways that we can respond to inflation. One way is to look in our own ‘shopping basket’ and see how much our spending aligns with what’s important to us.

Often, a limited budget can teach us important lessons – like how to use our resources wisely and reflect on what’s most important.

If we rein in our spending (of money, time, or attention) of the things that don’t add to our quality of life, we’re able to re-route some of those resources so we can afford to be more generous towards the people, hobbies or causes we value the most.

In shopping terms: fill your basket with what nourishes and shelve the rest.

If you’re shopping for financial advice that aligns with your goals and values, get in touch with an adviser from Align Financial on 02 9913 9995.

*Monthly CPI figures are also available from the ABS website: