You may have read about Armaguard Australia in the news recently. Armaguard is one of the nation’s last remaining cash transit companies, servicing stakeholders across the banking, retail, hospitality, medical and government sectors. The company has been teetering on the brink of collapse. Its recent risk of insolvency has been due primarily to one thing: the sharp decline in cash transactions.

Cash Transit Company, Armaguard Australia, is facing potential insolvency due to Australians using less cash in their day-to-day transactions.

Cash in decline, but access still important

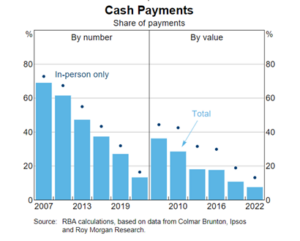

Digital payment platforms, contactless card payments and online transactions have been designed to seamlessly integrate with our day-to-day lives. According to a recent Consumer Payments Survey from the Reserve Bank of Australia (RBA), cash payments have dropped from 32% of all transactions to just 16% in the past three years. It’s been trending that way since the 2000’s and continued to accelerate through the COVID pandemic and beyond.

https://www.rba.gov.au/publications/bulletin/2023/jun/cash-use-and-attitudes-in-australia.html

An RBA snapshot shows that 94% of all in-person payments in Australia are now contactless. What’s more, one out of every two Australians don’t use cash for at all during a typical week.

While a transition to a completely cashless society does not seem imminent, or even certain at this stage – the world does seem to be heading in that direction. Rapidly.

The decline in cash use, transit and access poses complex and interrelated challenges, affecting businesses and the people they serve. Businesses like Armaguard are fundamental to the future of cash as a viable means of payment. Flow on affects from such companies can affect many stakeholders. And it doesn’t take long for there to be flow-on effects.

Armaguard’s predicament has prompted renewed talk around government regulation of digital payment services to navigate the transitions within Australia’s changing payment landscape. The RBA, banks, and the Australian government are working collaboratively towards modernising Australia’s payment systems and ensuring continued access to cash.

One key objective has been to ensure people still have access to ATMs where there‘s continued demand. Ultimately, banks will make commercial decisions in the interest of their shareholders. If they aren’t getting a return from having ATMs in operation, they won’t hesitate in removing them. If you want your local ATM to remain, the old adage still applies: use it or lose it.

Cash will likely be still around for a while to come, but the escalating challenges of its distribution remain.

If you’re concerned about how events may affect your investments, or for advice on navigating changes, get in touch with your trusted adviser at Align Financial.