Most of us would know the difference between investing and gambling and if we had to mention a single commonality between the two, it would be that both contain an element of risk. But that’s where the similarities end.

The recent headlines on the high-stakes action of GameStop, an American chain of video games stores, triggered by users of the internet forum Reddit (r/wallstreetbets), perhaps has its positives in drawing an unconventional crowd to the world of investing.

In January 2021, users on Reddit’s forum WallStreetBets congregated the belief that the company GameStop, a retail chain which was struggling due to the up-rise of digital distribution services, was significantly undervalued. GameStop’s shares were being bought short – a strategy whereby investors or short-sellers target falling stocks to gain a profit. This occurs when short-sellers borrow stocks from a broker and immediately sells them, hoping the price of the stock will fall, to which they can buy back later for a lower price, return the borrowed stocks and pocket the difference.

Users of the forum rallied to purchase even more GameStop shares to drive up the share price value and expose short-sellers.

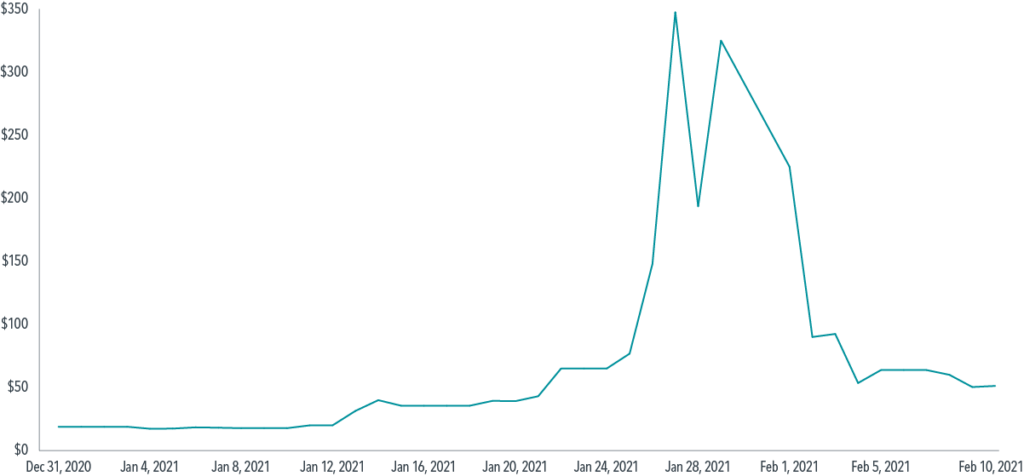

As a result, at the end of January 2021, GameStop shares went up almost 30 times to $350 USD per share.

Less than a week later, the share price dropped by 80%.

GameStop Closing Prices from 31 December 2020 to 10 February 2021

Source: Dimensional Fund Advisors

Such highs and lows emphasise the importance of investing for a consistent, long-term solution, rather than the high volatility experienced from placing all your eggs in one basket or one stock.

Individual stocks are one of thousands of options. Trying to pick a winner is like betting your hard-earned savings in a casino – while you can win big on a single bet, the odds are against you when it comes to picking the right stock and also at the right time.

Empirical data tells us that you’re better off betting with the whole market rather than on individual companies. Through a low-cost, highly diversified portfolio, investors can grow their investments by letting time and compounding interest do the work.

Investing is fundamentally different to gambling in the following ways:

Time and patience

Investing requires time and patience. It’s a long-term process that requires you to stay-put, ride out the bumps and trust in the market to provide you with higher than cash returns over time. Investing for the long-term teaches you to block out media noise and put aside certain emotions and follow your plan to achieving your goals. Gambling tends to ride more on your emotions and short-term impulses, which can be detrimental to your wallet.

Diversification

Spreading your money in a variety of asset classes is typical of an investor striving for long-term success. The idea of not putting all your eggs in one basket and having some cushioning in defence assets to mitigate any potential losses is a strategy that helps you prepare for any market downturns. When you’re gambling, there’s no loss-mitigation strategies; if you don’t win you can end up losing all of your savings.

Information

With investing, increasing your odds of winning requires knowing the right information to help you make educated and informed plans. It involves making sound decisions based on good research that have a high likelihood of success. By contrast, gambling often entails little to no research or information. If you sit at a roulette table in a casino, you have no idea what happened the day or week or month prior (nor does it really matter as neither a plastic ball nor a spinning disc have a memory).

Investing and gambling use very different methods to try to obtain money. One is systematic and aims for the long-term whilst the other is not; investing behaviour is risk-averse whilst gambling behaviour is risk-seeking.

The question comes down to this: on the spectrum of risk, what can you afford to lose?

The GameStop incident serves as an opportunity to highlight the importance of investing in a diversified portfolio, rather than on a few concentrated stocks that risks losing your entire wealth pot.

What Can Align Financial Do For You? Visit our homepage to learn more about our service. If you would like to speak to us about your financial circumstance, please feel free to give us a call on 02 9913 9995. We are located in Narrabeen on the Northern Beaches of Sydney.

.

Disclaimer: This post has been prepared for general information purposes only. It is not specific advice to any particular person. You should consult an authorised Align Financial adviser before making financial decisions. Align Financial | Financial Planner Northern Beaches | Servicing North Narrabeen, Narrabeen, Mona Vale, Elanora Heights, Newport, Avalon, Palm Beach | Enquire with us online

.