Investing in infrastructure means you’re putting money into companies that own and operate essential public assets.

These assets are usually necessary services to the community and include the following:

- Toll Roads

- Railways

- Airports

- Ports

- Water and electricity supply

- Communication Assets

- Hospital and education facilities.

Given their history of being government owned/managed, infrastructure assets are generally monopoly-like in the markets they serve and so they are relatively safe from a weak economy. Take for example toll roads; generally, a toll road is not the only route available to drivers but most of the time they exist as a faster alternative to free routes, and thus become monopolistic, facing no other real alternatives.

Infrastructure investments are attractive for investors looking for steady, predictable returns with less volatility than other companies . As such, they can be a great addition to a diversified portfolio.

Here are some of the pros and cons of investing in infrastructure:

Pros

- Infrastructure assets are generally monopolistic with little competition;

- Relatively insensitive to an uncertain economy;

- Somewhat protected from inflation;

- Provide a steady, relatively high-income yield.

Cons

- Subject to political and regulatory risk (government needs to be willing to spend on infrastructure);

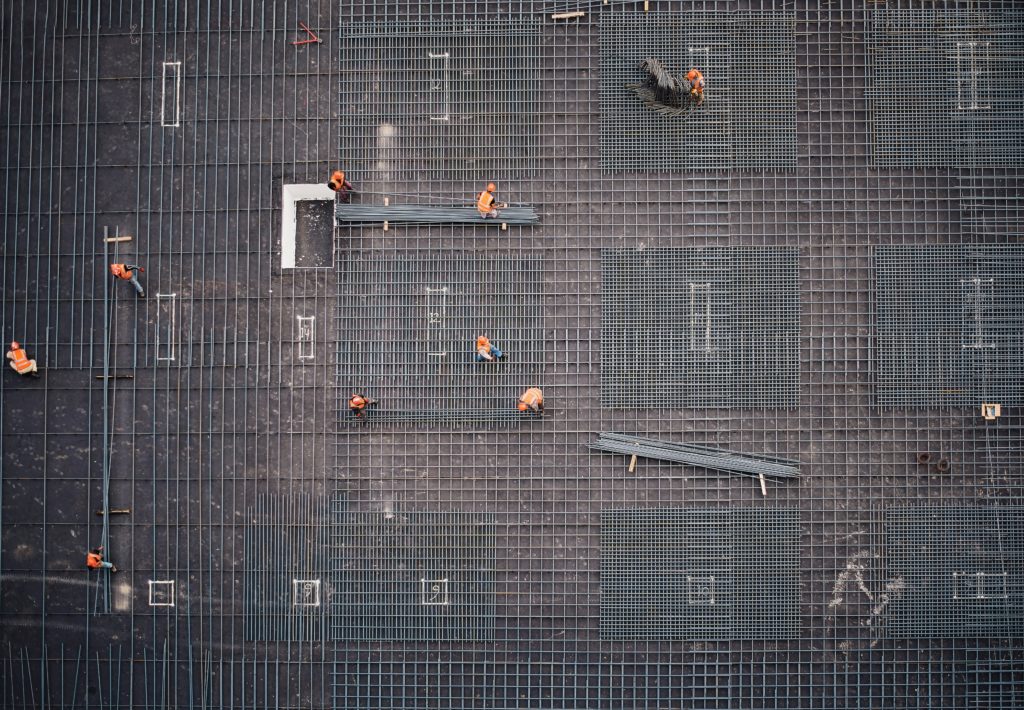

- Development risk (construction and development of infrastructure assets can take many years and require significant capital);

- Operational risk (careful asset management is essential to strong financial performance)

Infrastructure companies face risks that are different to other asset classes; they are relatively insensitive to economic factors but more susceptible to a set of uncorrelated risks as mentioned above.

Having said that, investing in infrastructure is a good way to diversify your overall portfolio and provide a stable income stream. The income generated is mostly inflation protected, meaning they provide a hedge against the rise in prices of goods and services over time.

It is important to consider your financial circumstance and how infrastructure may fit in your investment portfolio.

If you would like to know more about infrastructure investing, please get in touch with us.

What Can Align Financial Do For You? Visit our homepage to learn more about our service. If you would like to speak to us about your financial circumstance, please get in touch. We are located in Narrabeen on the Northern Beaches of Sydney.

.

Disclaimer: This post has been prepared for general information purposes only. It is not specific advice to any particular person. You should consult an authorised Align Financial adviser before making financial decisions.

Align Financial | Financial Planner Northern Beaches | Servicing North Narrabeen, Narrabeen, Mona Vale, Elanora Heights, Newport, Avalon, Palm Beach | Enquire with us online

.