Although Self-Managed Super Funds (SMSFs) are normally not permitted to borrow, one of the exceptions to this rule is an SMSF Limited Recourse Borrowing Arrangement (LBRA).

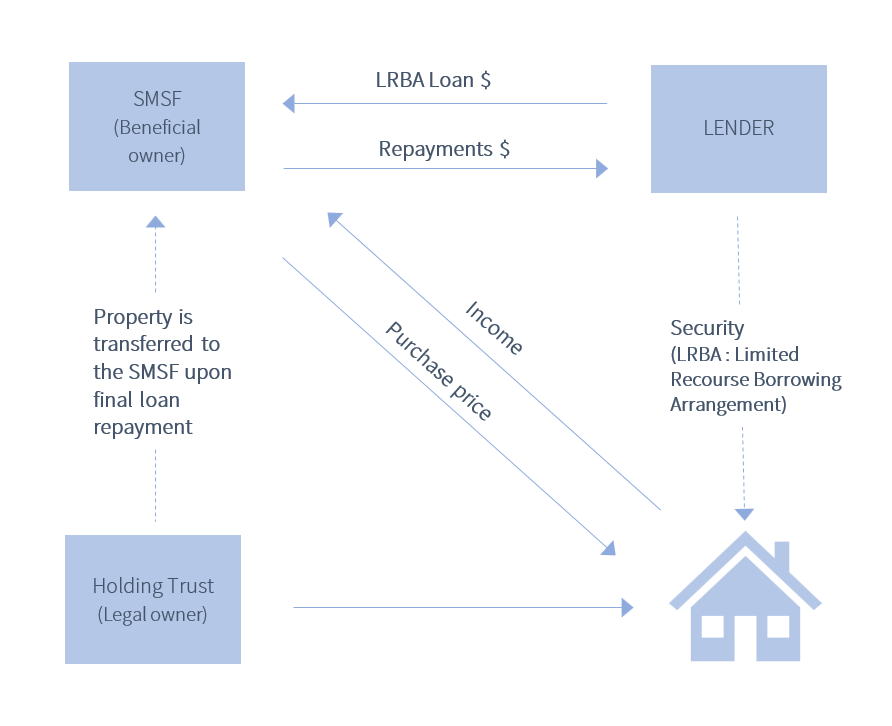

A simple outline of how this works:

- Your SMSF wants to buy property. It doesn’t have enough to pay for the full purchase. It seeks out a loan from a lender.

- The lender or the SMSF sets up a Holding Trust which becomes the legal owner of the property

- The lender sets up a LRBA loan to your SMSF

- Your SMSF pays for the purchase price of the property

- Income from the property goes to the SMSF

- The SMSF makes repayments to the lender

- Once the loan is repaid in full, the property is transferred to the SMSF.

An LBRA gets its name because in the event the SMSF defaults on the loan, the lender’s rights are limited to the asset held in a separate Holding trust (also known as a Security Trust, Bare Trust or Security Custodian Trust). The rights of the lender against the SMSF trustee are limited, meaning other assets in the SMSF are protected.

This is a simple model of how SMSF property borrowing generally work.

SMSF Lending is complex and care is needed to make sure you document all dealings correctly. Please contact me for professional advice before applying for a SMSF loan.

What Can Align Financial Do For You? Visit our homepage to learn more about our service. If you would like to speak to us about your financial circumstance, please feel free to give us a call on 02 9913 9995. We are located in Narrabeen on the Northern Beaches of Sydney.

Disclaimer: This post has been prepared for general information purposes only. It is not specific advice to any particular person. You should consult an authorised Align Financial adviser before making financial decisions. Align Financial | Financial Planner Northern Beaches | Servicing North Narrabeen, Narrabeen, Mona Vale, Elanora Heights, Newport, Avalon, Palm Beach | Enquire with us online.